On July 27, 2016, I presented “A Foreigner Buys Property in Japan” to the Japan-America Real Estate Coalition Office (JARECO), a Tokyo-based organization that researches international real estate.

The presentation was designed to help local practitioners understand how foreigners see real estate in Japan.

The presentation covers:

- The obstacles foreigners face when buying real estate in Japan

- The changing role of foreigners in Japan’s property market

- Why foreigners buy real estate in Japan, including generous rental yields, reasonable tenants and solid value for money

- Long-term opportunities in Japanese real estate, including tourism, rural areas and agriculture

(2,900 words, 15 minutes reading time)

A foreigner buys real estate in Japan

In my presentation, I’ll tell you about my experience writing Landed Japan. I’ll also describe some of the lessons I learned buying property in Tokyo, and explain why Japan is an attractive place for foreigners to purchase property.

I hope to help you understand how foreign buyers see the Japanese property market and help you serve non-Japanese customers more effectively. To do that, I’m going to look at the recent past and the current market. I’ll also make some predictions about the future.

A little background

Let me start with some background. I am a Canadian entrepreneur who has lived in Hong Kong since 1992. I’m also the author of the Landed series of real estate books, which includes books about Hong Kong, Japan and China. The fourth book, Landed Global, explains how to buy property across international borders.

The first edition of my first book—Landed Hong Kong—was published in 2008, and became a local bestseller. About 95% of Landed Hong Kong was based on my experience buying and renovating an office, an apartment and this factory in Hong Kong. The remaining 5% was fresh research.

I published my second book, Landed Japan, in 2010. That was before I had bought property in Tokyo. Landed Japan was based on desk and internet research; interviews with developers, agents, lawyers and architects; and case studies about foreigners who had successfully bought property in Japan.

Using that research, in November 2010, I bought a 22-square-meter apartment in Itabashi-ku for ¥4.9 million. The apartment, which is next to the Shuto Expressway, was built in 1974 and came with a tenant, a retired civil servant. The insights I will share with you are based on my research for Landed Japan and from nearly six years a landlord.

The booming 1980s

Let me start at the beginning. From 1989 to 1992—long before I started writing books or buying property—I lived in Tokyo. I rented apartments in Koenji—still one of my favorite neighborhoods—Ichigaya-Yakuoji and Higashi Nakano. That introduced me to basic Japanese real estate practices—like the need for key money and a guarantor—and to the practical realities of Japanese apartments.

In Tokyo, I worked for a company that produced annual reports for clients like Nissan, Mitsubishi Petrochemical and the former Bank of Tokyo. That helped me understand how Japanese businesses operate. Along the way, I made many friends and developed a deep appreciation for Japan.

This experience gave me a head-start, especially compared with people who had never been to Japan, or who had only visited as a tourist.

When Landed Hong Kong was successful, I wondered what other markets I could write about. I realized Japan could be an interesting subject, and that’s how I ended up writing about—and owning—property in Japan.

Foreigners and Japanese real estate

Now I’m going to talk about how foreigners’ role in the Japanese property market has changed since the boom years. Specifically, about foreigners’ motivation for buying in Japan and the information and services available to those buyers. Until recently, most of the foreign individuals who bought property in Japan were long-term residents.

These buyers had a connection to Japan, such as a Japanese spouse or an interest in Japanese culture—like anime or sumo—that motivated them to overcome the obstacles to buying property. The majority of these people were buying a home for their family, not investing in an apartment block.

In addition to a spouse, the early buyers typically had friends, co-workers and an extended family to help them learn about the local property market, find an agent and get a mortgage. Many foreign buyers spoke Japanese and worked for prestigious Japanese companies that could provide key introductions. There were not many foreign buyers, so it was easy for the real estate industry to ignore them.

The foreigners return

In the 2000s, it became more common for foreigners living in Japan to buy investment properties. Then, ski resorts like Niseko began to attract buyers from Australia, New Zealand, Taiwan and Singapore. Today, people buy property in Japan from traveling exhibitions in Hong Kong and Singapore, and from companies like Mitsui Fudosan and Daikyo that have set up overseas offices. Some buyers have never visited Japan, and buy properties sight unseen.

Today’s buyers may have an affection for things Japanese, but they are also motivated by rental yields and capital appreciation. And where yesterday’s sumo or anime fan would look only at Japan, the new breed of buyers compares Tokyo’s nightlife with São Paulo’s and Niseko’s snow with that of Whistler in Canada. These people are less tolerant of Japan’s quirks and idiosyncrasies. If you make the process too difficult or unattractive, they will buy somewhere else.

Chinese buyers

Another big change is the rise of the Mainland Chinese buyer. Many of these buyers want to move their wealth out of China, and this motivation can be more important than capital gains or rental yield. By law, Chinese citizens are only allowed to take the equivalent of US$50,000 in or out of China each year. Additional funds require special approval.

Mainland buyers have a strong preference for new property and often buy homes for their children. They are superstitious, especially when it comes to avoiding the number four—which sounds like “death”—liking the number eight—which sounds like “success”—and shunning locations with bad feng shui. Which brings me to Information.

English-language information

When I started researching Landed Japan, there was very little English-language information available for home buyers. Local real estate agents’ listings were almost all in Japanese. Large international brokers provided little research coverage of residential housing. Mortgage lenders and developers were the same. If you could find information in English, it was usually an annual report or corporate brochure that didn’t address the questions that a buyer would have.

There were exactly two books about Japanese real estate, both of which were written for institutional investors. The Nikkei Real Estate Market Report was useful, but was also for institutional investors.

Some government ministries—like the Cabinet Office—continue to publish English-language materials, as do trade bodies like the Real Estate Companies Association of Japan. I learned the value of research produced by universities and think tanks, and devoured stories in The Japan Times and other media outlets. But most of this was high-level social and economic information that was of limited use to a home buyer.

Things have improved since 2010. But if you do an internet search for “buy property in Japan,” there is far less information available than for countries like the United States or France.

Japan is different

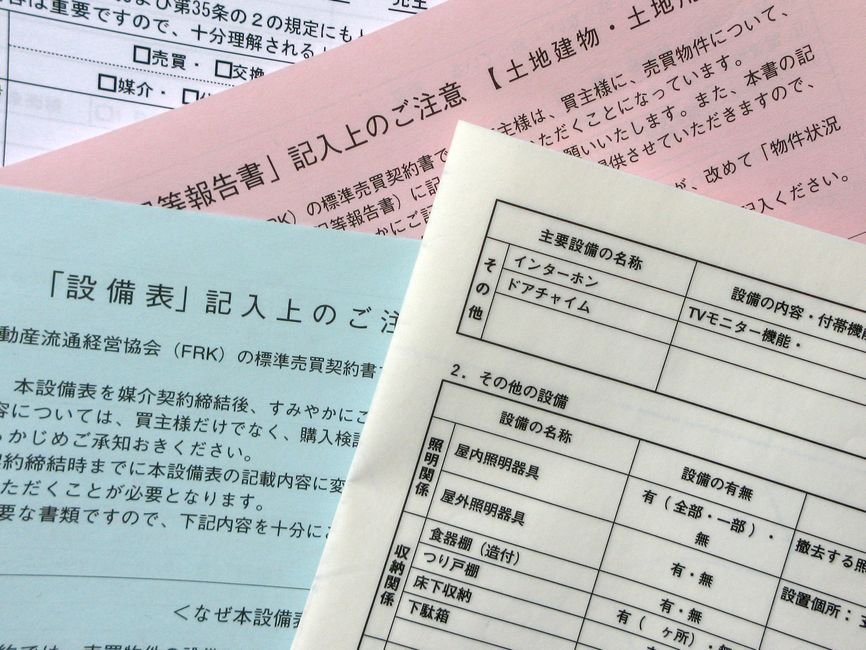

The lack of information is an issue because many Japanese practices and processes are perplexing to foreign buyers. For instance, zoning regulations that put homes next to industrial zones. Other examples include:

- The explanation of important matters

- Japanese addresses

- Earthquake insurance

- Property taxes

- Listings on the Real Estate Information Network Systems (REINS)

- The use of hankos

- Japan’s tenant protection laws, and

- Japanese banks’ reluctance to lend to foreigners.

This is further complicated because much business in Japan is done on the basis of trust, and foreigners generally don’t trust real estate people. That represents an opportunity for companies that can build trust and provide clear, unbiased information. Which brings me to service.

Serving non-Japanese clients

When I started researching Landed Japan, obtaining service from local companies—in Japanese or in English—was difficult. I contacted dozens of developers, agents and banks. Some simply said “no,” or ignored my requests for information. Others gave me the runaround that happens when people want to say no, but don’t want to cause offense. Through persistence and luck, I found people and companies who were willing to help. But if I was a buyer and not a writer, I would have simply given up.

Many Japanese companies are not set up to serve non-Japanese clients. One reason for this is that foreigners are a small market. Another is that foreigners are often seen as being difficult, because they don’t understand or accept the Japanese way of doing things. For example, they want to use a lawyer in the negotiations. Or they insist on spelling-out every detail in the contract. Or they want to hire a building inspector. These things are common in the West, but not in Japan

Follow the leaders

Clearly, local companies have no obligation to turn themselves inside out to serve foreign customers. But there is money to be made, and some companies—like BIC Camera and the duty-free stores in Akihabara—actively court this market.

It’s OK to say “no” if your organization isn’t interested in these customers. But you should consider partnering with a company that does want to serve this market, so you can benefit from referrals.

If you do want the business, ensure your front-line staff, such as receptionists and salespeople, have the training and resources they need. Your staff should see these buyers as an opportunity, not a problem. And don’t worry about having perfect English. Most people are willing to meet you half-way.

To summarize, you will be more successful serving foreign buyers if you understand their motivation; if you are prepared to explain the nuances of Japanese real estate and if your people and systems are ready to serve those clients.

That sounds like a lot of work, doesn’t it? But I think it’s worth the effort, because—from a foreigner’s perspective—Japan has 10 powerful advantages. Let me give you some examples.

Ten reasons foreigners buy real estate in Japan

First, in comparison to many places, Japan offers excellent value. In Hong Kong, where I live, HK$8 million—roughly ¥100 million or US$1 million—will buy you about 400 square feet of usable space in a 20-year-old building in Midlevels. That’s about 11 tsubo in a nice, but not a top-end neighborhood. Prices in Singapore, Shanghai and Beijing are similar.

Furthermore, property prices in Japan do not correlate with prices in Hong Kong, Singapore, Shanghai and Beijing. That lack of correlation makes Japan a useful addition to a diversified property portfolio.

A level playing field

In Japan, it’s easy to own freehold land. Contrast this with Hong Kong, where all the land—except the ground under St. John’s Cathedral in Central—is owned by the government and leased to users. Mainland China is similar to Hong Kong, except no-one knows what will happen at the end of the government land leases. In the Philippines and Thailand, foreigners can own condominiums, but not the land under the building. This makes Japan an inviting and safe place to invest.

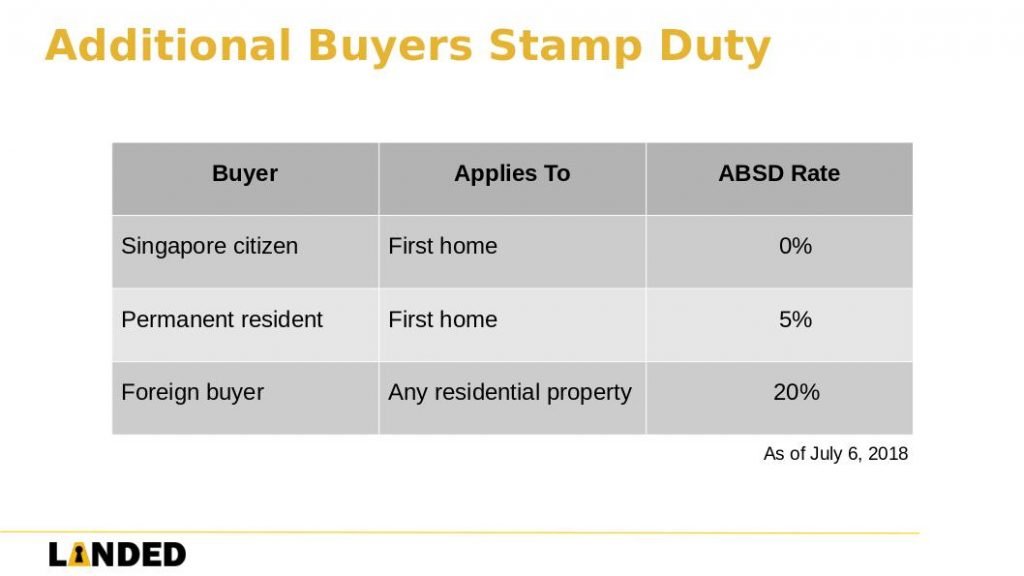

Third, Japan doesn’t discriminate against foreigners with added taxes or restrictions. For instance, in Hong Kong and Singapore, people who are not citizens or permanent residents pay higher taxes when they buy property. In Canada, when a non-resident sells property, the government withholds 25%–50% of the proceeds until the owner can prove that all taxes have been paid. In Australia, foreigners cannot buy pre-owned homes without special permission from the government.

Construction quality

Fourth, Japan’s seismic engineering is superb. That’s not true in many earthquake-prone places. For instance, in February 2016, after a magnitude 6.4 earthquake struck Taichung, Taiwan, the Weiguan Golden Dragon Building collapsed, killing at least 39 people. The building’s walls were filled with empty cooking oil cans to save on the cost of concrete.

In the past, Japanese homes were criticized for having a 30-year lifespan, under the “one home for one generation” concept. Today, developers are building long-lifespan houses and apartments that can be renovated. And Japanese homes now incorporate environmentally friendly designs and components, like solar panels.

Fifth, for landlords, the high yields in Japan are a key draw. Net yields of 5%–6% are relatively easy to obtain. If you assume a little more risk with an older building in a less glamorous location, higher returns are possible.

On the other hand, in China’s tier-one cities—Beijing, Guangzhou, Shanghai and Shenzhen— investors often leave their new home’s interior unfinished. Rental yields are so low that owners can’t be bothered to decorate the home and find a tenant.

Good tenants

Sixth, most Japanese tenants are stable and well-behaved. It’s common for people to rent the same home for decades. In my experience, tenants’ requests for improvements and renovations are modest. There are exceptions to every rule, but Japanese tenants typically pay their rent on time with little fuss.

Seventh, Japan is an orderly, law-abiding society. The rule of law is well established and lawsuits are relatively rare. Furthermore, Transparency International ranked Japan the 18th least corrupt country in its 2015 report, well ahead of France, Taiwan, South Korea and Italy.

Eighth, Japan offers excellent public infrastructure. If you live in a city like Bangkok or Jakarta, where traffic is unmanageable, Japan’s efficient, reliable public transportation is a joy.

When it comes to culture, festivals like Fuji Rock, as well as the country’s parks, architecture, Michelin-starred restaurants, art museums and concert halls make Japan a great place for a pied-à-terre.

Low prices

Ninth, despite Japan’s reputation for being costly, it represents a bargain for shoppers and diners. In Japan, four adults can eat and drink well for US$100, something that is difficult in Hong Kong or Singapore.

Finally, Japan’s blue skies are a welcome relief from cities like Guangzhou, where choking air pollution is common. Even relatively clean cities like Hong Kong and Singapore suffer from the same problems when the wind blows the wrong way.

Those are just a few of the attractions that foreigners see in Japan today. Looking forward, I see three key opportunities for foreigners investing in Japanese property.

Long-term opportunities

One of the most promising is tourism. The Japanese government has set a target of 40 million visitors by 2020 and 60 million by 2030, and is working to legalize casinos. But Japan suffers from a shortage of hotel rooms. According to one estimate, with 25 million visitors per year, Japan has a shortfall of 10,000 hotel rooms.

That represents an investment opportunity for everything from minpaku hosts and budget hotels to integrated resorts. Tourism investments are made even more attractive by the government’s plan to increase foreign direct investment in Japan to ¥35 trillion by 2020, more than double the amount recorded in 2012.

Rural areas

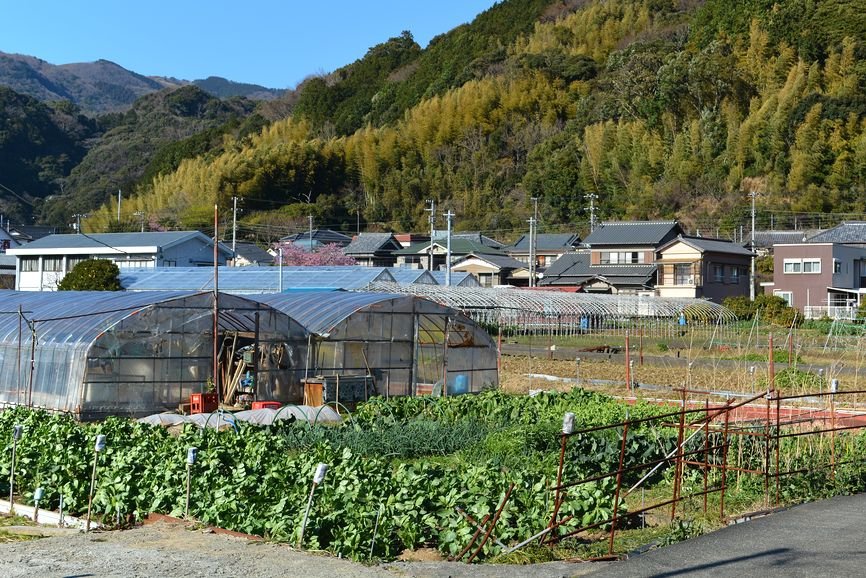

Second, in a part of the world where space and fresh air are at a premium, Japan’s rural areas have great potential. Whether they are used for artists’ communities, vacation homes, hubs for research and development, or healthcare centers, many depopulated areas offer inexpensive land, transport infrastructure and natural beauty.

Furthermore, the government’s tourism push is encouraging people to visit Okinawa—which has excellent scuba diving—and other destinations outside of Tokyo, Osaka and Kyoto. Immigration reforms will see more skilled and unskilled workers enter Japan, creating additional housing demand.

Agriculture

Finally, there is long-term potential in Japan’s agricultural sector, where the government set a target of increasing the value of food exports to ¥5 trillion per year by 2030. Japan’s expertise in biotechnology, coupled with its reputation for producing high-quality seafood and fruit—like ¥10,000 “perfect” melons—are an excellent start. Furthermore, Japan has 165 high-tech “vegetable factories” operated by companies like Mirai Corporation. This market is expected to reach ¥30 billion yen annually by 2020.

Efficiency gains from automation and deregulation, and from amalgamating Japan’s many small farms into larger, more competitive units, will help this process. So will the growing wealth of Japan’s neighbors and the passage of the Transpacific Partnership.

Make no mistake, there are challenges ahead. These include the strong yen, an aging and shrinking population, and the need for deregulation and regulatory reform. But even with these challenges, there is a growing number of foreign investors who see potential in Japan, today and tomorrow.

Thank you.

Click here for more articles about property in Japan.

Christopher Dillon has owned residential, industrial and commercial real estate in Hong Kong and Japan. He is the author of the Landed series of property books. The second edition of Landed Japan is available from Amazon.

* * *