On November 9, 2015, I delivered a presentation entitled “Hong Kong property without tears” to the American and Canadian chambers of commerce in Hong Kong.

Many things have changed since I delivered the presentation. But Hong Kong remains one of the world’s most expensive cities, and transaction costs are high. Politics are a prominent part of life in our congested city. And—from urban to rural, and old to new—Hong Kong offers a range of property options.

The presentation covers:

- Political and economic factors that shape the price of Hong Kong property

- Taxes and fees you’ll pay when buying real estate in Hong Kong

- Prices of typical dwellings in different neighborhoods

- Techniques for researching a Hong Kong property purchase

- Common pitfalls, including unauthorized building works

- How property in the New Territories, including Lamma and Lantau, differs from other parts of Hong Kong

(3200 words, 17 minutes reading time)

Executive summary

If you are going to buy in Hong Kong, start with a personal inventory. Then familiarize yourself with the political and economic factors that support our high property prices. You’ll want to budget appropriately—including all taxes and fees—and consider what an interest rate increase or a market correction would do to your plans.

With a realistic budget, you can decide between a new home and an older one; and between a city center and a rural location. You can then research your target neighborhood, building and home to ensure they don’t have problems like nearby infrastructure projects or unauthorized building works. And remember that due diligence is particularly important if you are buying in the New Territories.

Hong Kong property without tears

Today, I’m going to describe the political and economic fundamentals of Hong Kong’s property market. Next, I’ll review the numbers for a typical home purchase and describe what your dollar buys in different parts of the city. Then, I’ll share techniques for researching your purchase and avoiding common pitfalls, like unauthorized building works. I’ll wrap up with a quick look at the unique situation in the New Territories.

Where is the market going?

But before I do that, I’ll answer the two questions that are at the top of everyone’s mind. First: Is the property market going up or down?

More than a century ago, someone asked the legendary American financier J.P. Morgan a similar question about the stock market. He replied: “It will fluctuate.”

As with the stock market, no one knows where Hong Kong’s real estate market is headed. And anyone who tells you they do is a charlatan or talking-up their own book.

Having said that, Hong Kong residential property is the most expensive on earth, according to research released by CBRE in October 2015. It is also at, or very near, the top of its historic range. The same month, UBS said Hong Kong was second only to London in being at risk of a bubble and The Economist claimed that Hong Kong home prices were 89% over-valued compared to rents. Finally, the Hong Kong government is making more land available for development and has a target of 86,000 new, private-sector apartments over the next three to four years. That’s the case for falling prices.

But there is more to the story. Despite recent hiccups, Hong Kong continues to benefit from the economic miracle to our north. While growth has slowed, China’s government has lifted more people out of poverty than any other administration in history. Furthermore, we are now in an unprecedented seventh year of zero interest rates, and in October 2015 the president of the Minneapolis Fed suggested that the United States should consider introducing negative interest rates. In short, we are in uncharted economic territory, where historical models have limited utility.

Should I buy Hong Kong property?

That brings us to the second question: Should I buy Hong Kong property?

The answer to that question is: Maybe. There is a lot about the home buying process—like the direction of interest rates and the intricacies of the Hong Kong government’s housing policy—that is unknown. But there are many aspects where you have unique insights. And if you are thinking of buying a home in Hong Kong, that’s where you need to start. Before you consider floor plans, color schemes, neighborhoods or mortgages, you need to take a personal inventory. For example:

- How do you feel about Hong Kong? Is it home, or a place you barely tolerate? Does your family like the city? How long do you plan on living here?

- Does Hong Kong meet your needs? Do you have an asthmatic child in the house? Or someone with special educational or physical needs?

- Can you find a suitable home for your lifestyle? Is your family growing or shrinking? Do you plan on aging in place? What about pets? Or hobbies, like sailing?

- How secure is your job and your income? Do you work for a multinational that could transfer you to the other side of the planet tomorrow? And could you afford to keep an apartment here if they did?

You might reach the end of these questions, and decide to rent instead. And that’s OK. But if you do decide to buy, you’ll need to understand the political and economic forces that drive our market.

Politics

Hong Kong is unique. It’s a densely populated city, where 7.2 million people are jammed into 1,100 square kilometers. Less than 7% of the city’s land is used for housing.

We’re the capital of the Pearl River Delta—which the World Bank recently called the planet’s largest urban area—but the boundary between Hong Kong and China and our government’s land policy keeps property prices artificially high.

Second—except the land in this picture—the Hong Kong government owns all the city’s land. Much of our housing and development policy is made behind closed doors and our government likes mega-projects, such as the Hong Kong–Macau–Zhuhai Bridge and new rail lines. In his 2015 policy address, Hong Kong’s chief executive announced plans for the East Lantau Metropolis, a development that would reclaim 1,000 hectares in the sea off Pokfulam.

Hong Kong’s large surpluses mean that we have no problem paying for projects like this. But they can have a big impact on property values, and on your ability to enjoy your home.

Third, the Hong Kong government must balance two conflicting goals: On one hand, it has to provide affordable land for the city’s residents—45% of whom now live in subsidized housing. On the other, government must support property values to protect homeowners, investors, banks and developers. A large price drop would inflame the middle class, which has much of its wealth in real estate, and would cripple the economy.

Hong Kong and China

National politics are another issue. In 1997, Hong Kong became a Special Administrative Region of China. The Basic Law, which is our mini-constitution, guarantees Hong Kong a high degree of autonomy for 50 years. But what happens after 2047 is an open question. In 2017, 30-year mortgages will span the end of the “One Country, Two Systems” era, bringing this issue to the fore.

People from the Mainland have bought a lot of real estate in Hong Kong, which has helped to drive prices to record highs. But as casino operators in Macau can attest, when flows of hot money stop, business conditions can chill rapidly.

The U.S. dollar peg

Finally, the Hong Kong dollar has been pegged to the U.S. dollar since 1983. The link has withstood intense pressure during the Asian and global financial crises of 1997–98 and 2008–09, but there have been repeated calls from academics, bankers and politicians to scrap it. Meanwhile, the Hong Kong government issues regular statements that the peg is permanent. But anything is possible, particularly in a world where the U.S. dollar is losing its reserve currency status.

One side-effect of the dollar peg is that Hong Kong’s interest rates are set in Washington. Despite the talk of negative interest rates, many market-watchers expect quantitative easing to end and interest rates to rise. That will make mortgages more expensive, and may cool Hong Kong’s property market and the economy in general.

Where do I start?

So if you are comfortable with these dynamics and want to buy property, where do you start?

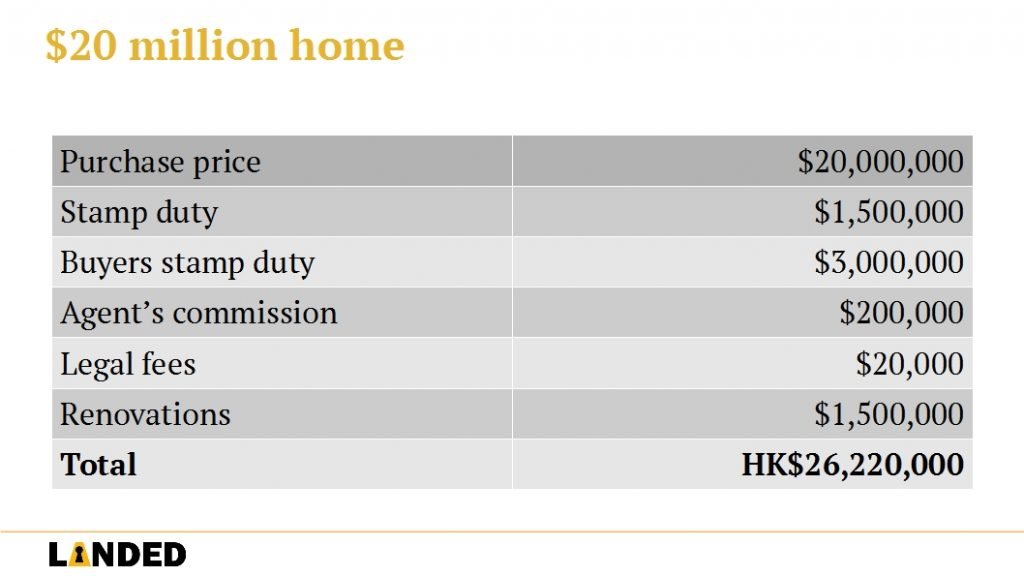

The first question to ask is: Do I have the financial resources to buy? Here’s a sample purchase that assumes that you are not a permanent resident and that you are buying a HK$20 million home. You will need a down payment of at least 50%, or $10 million. You will pay stamp duty of $1.5 million. Because you are not a permanent resident, you will pay buyer’s stamp duty of $3 million. You will pay the real estate agent 1% commission, or $200,000. Legal fees will be about $20,000. If you are buying an existing home, you will almost certainly renovate it. Add $1.5 million for renovations, for a total outlay of $26.2 million. Don’t forget contingencies, moving expenses, and furniture and appliances to complete your new home.

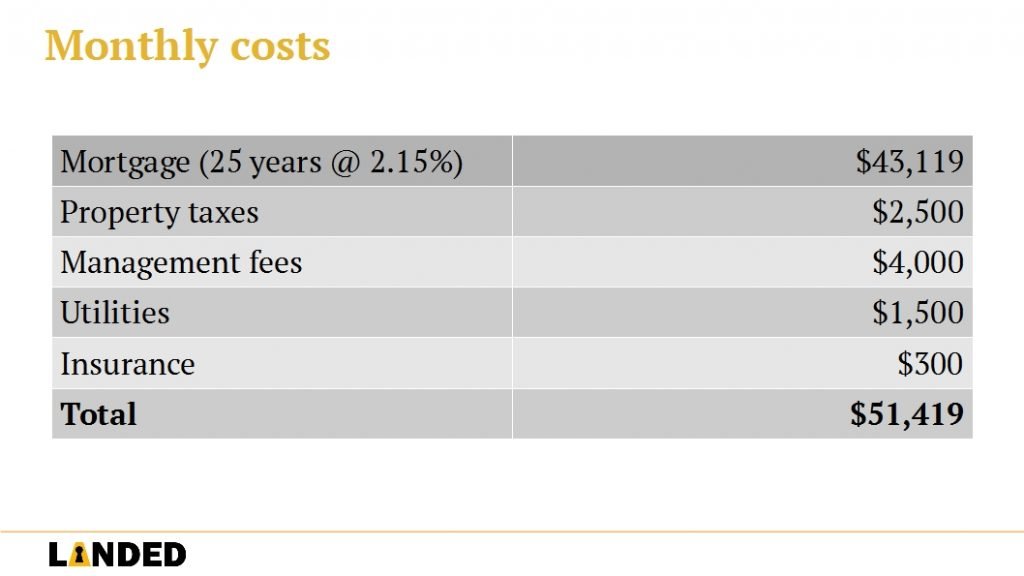

With a HK$10 million, 25-year mortgage at 2.15%, your monthly payment will be $43,000. You’ll pay property taxes, known as rates, of about $2,500 per month and management fees of around $4,000. With utilities and insurance, your monthly bill will be $51,000. After a year or two, you’ll need to start spending money maintaining and repairing the interior of your apartment. In an older building, you will need to budget for special assessments for big-ticket updates, like overhauling the elevators and replacing the roof.

If you are comfortable with these numbers, factor in higher interest rates. A one-percentage-point increase, to 3.15%, raises your monthly mortgage payment to $48,000. At 4.15%, you are paying the bank $54,000 every month.

Timing

You should also consider the possibility of a market correction, something that has happened several times before in Hong Kong. From a peak in the third quarter of 1997, home prices fell 50% over the next 12 months and remained in the doldrums through 2003, when SARS killed 300 people in Hong Kong. Another large, sustained downturn is possible.

If the numbers still make sense, consider how long you will be in Hong Kong. If you sell within three years of buying your home, you will face tax penalties of 10% to 20% under the special stamp duty program. I wouldn’t buy anything unless I planned to be here for at least five years. Ten years would be even better.

Next, where and what do you want to buy? One of the great things about Hong Kong is that there is a wide variety of options. For example, with our $20 million budget you could buy a 1,300-square-foot apartment in the building on the right. It’s 22 years old, is in Pokfulam on Hong Kong island and overlooks a cemetery, which is a drawback.

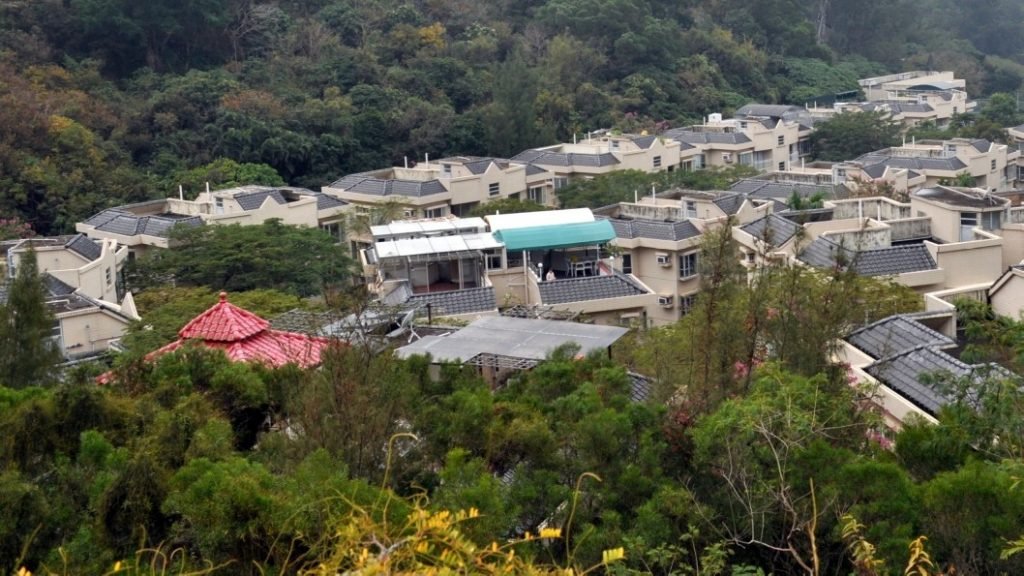

That same $20 million—or about US$2.6 million—will buy you anything from 500 to 1,700 square feet of living space, in buildings ranging from modern to ancient that are in urban or in rural settings, like this house in the New Territories.

These examples were gathered from real estate agents in June 2015. Prices have changed since then, but the relationship between the locations, the sizes and the ages of the homes is fairly constant.

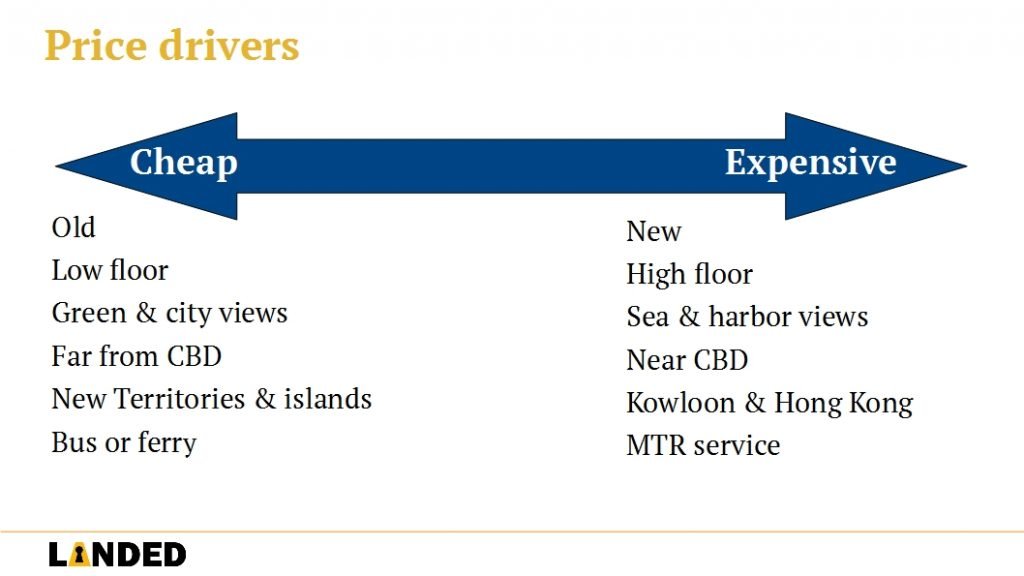

Trade-offs

Specifically, new homes are more expensive than old ones. That’s due to prestige, construction quality as well as maintenance costs. Noise, air quality and aesthetics make a high floor with a harbor view preferable to a low floor with a hillside or city view. A convenient location and access to public transportation, particularly the Mass Transit Railway, are desirable. Proximity to schools is always a plus. And except for luxury properties like those on the Peak or in Shek O, long commutes reduce values. Office prices and commercial and residential rents follow similar trends.

Don’t forget the health implications of your new home’s location. Research has shown that one of the best ways to improve your quality of life is to shorten your commute. Meanwhile, living in a noisy area with heavy air pollution can increase your risk of cardiovascular diseases, respiratory infections, diabetes and other conditions. And being surrounded by parks and other greenery has numerous benefits. For example, a recent study in the journal Landscape and Urban Planning found that residents of tree-lined streets in London were prescribed fewer antidepressants than people in a control group.

Researching Hong Kong property

With this information, you can start researching your new home. One of the best ways to learn about an area is to rent a unit in the neighborhood or—even better—in the building where you are thinking of buying. I’ve done this twice, once with an office in Sai Ying Pun and once with an apartment in Pokfulam. That’s how you discover how the daily commute really works; if you like the nearby restaurants; if the building’s security guards are attentive; if the neighborhood suits your tastes and whether the local grocery store stocks your favorite brand of toothpaste.

It’s also a good idea to walk through the neighborhood at different times of the day and night and on weekends. Regular strolls reveal a lot about the area and the people who live there.

For example, is the area being redeveloped? Are young families moving in, or are there many elderly residents? Are new businesses opening? Is the precinct gentrifying, with hardware stores and garages being replaced by trendy boutiques and bistros, like Western and Kennedy Town?

You can also search the internet and the media to learn about problems in a development. For example, several new buildings have been hit by “glass cancer,” a defect in glass cladding panels that causes them to pop out and shatter on the street below. High-profile violent crimes can taint an entire building and depress prices and rents. And some complexes, like Hong Kong Parkview, have their own website and Wikipedia page.

Friends, relatives and coworkers can be helpful, as can community forums and blogs. You may not get definitive answers from these sources, but you can gain useful clues that you can validate through official sources.

Unauthorized building works

One of the biggest pitfalls that you can face when buying a preowned home are unauthorized building works. In 2010, the government introduced the Minor Works Control System, which is a registration system for contractors performing small renovation projects. Until this program was introduced, contractors often modified homes in ways that were unsafe and did not have prior approval from the Buildings Department.

In addition to licensing contractors, the Minor Works Control System sets out procedures for having projects authorized and lists penalties of up to $400,000 and two years in jail for people who build or hire someone to build an illegal structure. Despite the system, in 2011 the government estimated that there were still about 400,000 illegal structures in Hong Kong.

Unauthorized building works create several problems for buyers. First, preowned homes are usually sold on an as-is basis. If the Buildings Department knows the home includes an illegal structure, it will issue a statutory order, which will be lodged with the Lands Registry. Your solicitor should tell you about the statutory order when she reviews the documents for the sale. An outstanding statutory order can make it difficult to get a mortgage and sell the property later. Illegal structures in common areas of a building, like rooftops, can be complex to resolve.

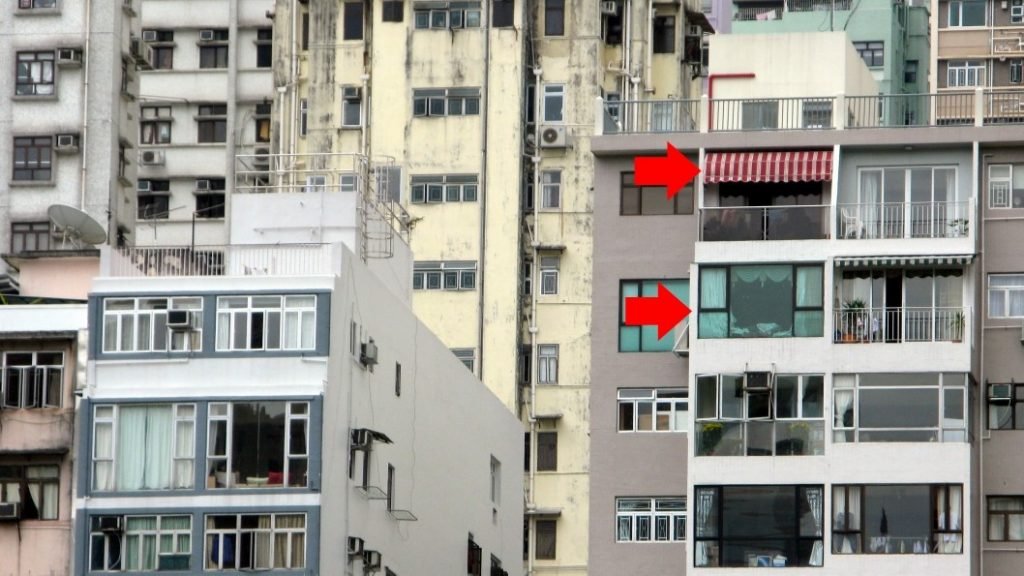

Illegal structures

Second, your new home could include an undocumented illegal structure. For example, judging by the neighboring apartments, the closed-in balcony and the awning shown in red in this photo are probably illegal. If you owned one of these units you could receive a statutory order demanding that you fix the structure, which may be unsafe as well as illegal. The Buildings Department has the legal power to fix unauthorized building works, charge you for the labor and materials, and add a surcharge.

While some violations are easy to spot, others are not. For example, here are before-and-after images of an illegal structure. One balcony is fully compliant, the other is not. The difference is HK$140,000 in repairs.

If you are concerned that there may be unauthorized building works in a home that you are thinking of buying, check the architectural plans with the Building Department. You can also hire a professional, such as an architect or an engineer, to review the home.

Dangerous slopes on your property can also result in large repair bills. And you can be liable for maintaining slopes that are on adjacent land, so be sure to have your solicitor investigate this.

Life in the New Territories

I’ll wrap up with a few words about life in the New Territories, where the air can be cleaner and property prices lower than in Kowloon and Hong Kong Island. Life in the New Territories is more rural than other parts of Hong Kong. But there are other important differences.

In some villages, such as Wing Hing Wai, poor urban planning has left streets so narrow that emergency vehicles cannot reach all the homes. In others, like Siu Hang Hau, access roads are in private hands, forcing homeowners to pay a “maintenance fee” to use the only road to their houses. As a result, a fresh survey and expert legal advice are essential for anyone buying landed property in rural Hong Kong.

Small houses in the New Territories can be erected without the supervision of an architect or engineer, and without having the plans approved by the Buildings Department. This lowers construction costs, but it can also lead to serious quality problems. Older houses often need new wiring and plumbing, and illegal structures such as unauthorized floors are common. A wholesale renovation can easily cost $3 million.

There are many other potential issues, ranging from snakes to survey problems, and from local politics to slow Internet speeds. So it’s a good idea to read up on the New Territories and the specific village where you are thinking of buying before you sign anything.

And now, I’d like to open the floor to your questions.

Thank you

Click here for more articles about property in Hong Kong.

Christopher Dillon has owned residential, industrial and commercial real estate in Hong Kong and Japan. He is the author of the Landed series of property books. The second edition of Landed Hong Kong is available from Amazon.

* * *